LENDING TO SMES AND ENTREPRENEURS IS IMPROVING, BUT MORE DIVERSE FORMS OF FINANCING ARE NEEDED

Fuente: OCDE.org

Financing for small and medium-sized enterprises (SMEs) has turned the corner from the downswing seen during the global financial crisis, but overall credit conditions remain challenging and access to external finance continues to be much tighter for SMEs than larger firms, according to a new OECD report.

Financing SMEs and Entrepreneurs 2016: An OECD Scoreboard underlines that SMEs remain over-reliant on bank financing and points out the need for a diversification of financing sources and instruments. The Scoreboard provides comprehensive data on debt, equity, asset-based finance, solvency and the framework conditions for SMEs and entrepreneurs, along with an overview of policy measures to ease SMEs’ access to finance in 37 countries. The OECD presented the report to G20 Finance Ministers and Central Bank Governors in Washington as part of wider discussions on developing policies to boost diversification of financing instruments, a key priority of China’s G20 Presidency.

“Finance is one of the keys for unlocking the potential of small firms to innovate, upgrade and become more productive,” OECD Secretary-General Angel Gurría said during a presentation of the Scoreboard with Zhou Xiaochuan, Governor of the People’s Bank of China, just prior to the G20 Finance Ministers meeting on 14-15 April in Washington. “The OECD’s new SME Scoreboard shows that while access and conditions to traditional credit for SMEs have improved since the worst point of the global economic crisis, governments can and should do more to tackle the longstanding obstacles to SME financing,” Mr Gurría said.

Governor Zhou said: “SMEs and entrepreneurs can play an active role in achieving stronger and more inclusive growth, and it is now time to show our commitment to enabling the development of alternative funding options.” He welcomed the new OECD Scoreboard, which he said would support efforts to develop policy recommendations on diversified financing for SMEs during China’s G20 Presidency. “The OECD Scoreboard is a valuable tool to support G20 work, and to monitor trends and the implications of financial reforms for small and medium-sized enterprises.”

The fifth annual edition of the OECD Scoreboard highlights developments in SME financing over the 2012-14 period. On the positive side, it shows that the outstanding stock of SME loans rose in 16 out of 27 countries, and new lending in 2014 surpassed 2013 levels in most countries. Similarly, credit conditions eased and interest rates on new loans to SMEs declined in 2014 in the majority of countries studied.

|

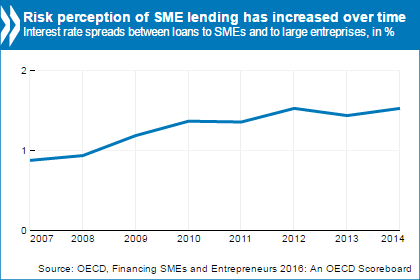

On the negative side, the interest rate spread between loans to SMEs and those to larger firms continued widening. This suggests that the risk perception of SME lending has increased over time. This perception appears out of synch with new data showing a clear downward trend in SME bankruptcies, which declined during 2014 in 20 out of 25 countries for which full data was available. While venture capital investments showed signs of recovery and the use of some alternative financial instruments - such as peer-to-peer lending, equity crowd-funding and factoring - continued growing, most non-bank financing instruments remain at the reach of only a small share of SMEs. |

|

A special chapter in this year’s Scoreboard focuses on how so-called Business Angel investors can help bridge the financing gaps for firms with high risk-return profiles during the early stages of development, and notes their importance in providing business advice, mentoring and networking opportunities. It also underlines the need to improve the evidence base to enable a better understanding of the potential of Business Angel investment to finance SMEs, and support the design of appropriate policy making.

To find out more about the OECD’s work on SMEs and entrepreneurship, please visit: http://www.oecd.org/cfe/smes.