GUYANA AND SURINAME FINANCE MINISTERS TO ATTEND ISLAMIC BANK MEETING

Fuente: Ray Chickrie, Caribbean News Now contributor

JAKARTA, Indonesia -- The finance minister of Guyana and governor to the Islamic Development Bank (IsDB), Winston Jordan, along with his Surinamese counterpart, Gillmore Hoefdraad, will travel to Indonesia to attend the 41st board of governors meeting to be held May 15-19.

Enhancing Growth and Poverty Alleviation through Infrastructure Development and Financial Inclusion will be the overall theme of this year’s meeting.

This annual high level meeting will gather the IsDB’s 57 governors, mostly finance and economy ministers, in addition to hundreds of policymakers and top leaders from various international and regional institutions. The meeting will also give stakeholders a platform to explore practical solutions, strengthen partnership and cooperation between its 57 member countries.

Suriname’s alternate governor to the Islamic Bank, Dr Anwar Lall Mohamed, will also accompany the finance minister to Jakarta. Suriname will have a packed agenda at the meeting due to some pressing economic and financial issues at home and will sign off on some joint projects with the Islamic Bank during the Jakarta summit.

The Islamic Bank has become more involved in the economic matters of Suriname, as it recently offered to a lend US$1.75 billion to Paramaribo, which is experiencing financial woes due to a drop in commodity prices.

Guyana will attend the meeting for the first time and Jordan will personally be in Jakarta to witness his country’s official initiation into the Islamic Development Bank. All 57 members of the Organisation of Islamic Corporation (OIC) are part of the bank, which is an organ of the OIC. Jordan hasn’t disclosed who he will name as alternative governor of Guyana to the Islamic Bank.

Guyana, which is experiencing brain drain, will need to appoint a person with economic and financial background but also knowledge of Islamic banking and finance as alternate governor to the bank. It will take Guyana some time to become familiar with the vast resources that the Islamic Bank and many of its branches offer.

The skills to tap these resources will pose a severe constraint for Guyana, diplomats say. However, neighbouring Suriname has offered to assist Guyana.

This year’s annual meeting will feature a huge innovation exhibition and more than 30 side meetings, seminars and knowledge sharing events on many important topics.

Suriname/Islamic Bank cooperation has accelerated in the past five years. Hoefdraad is now looking to enter a permanent member country partnership strategy agreement with the bank. Suriname included capacity building as one of its areas of engagement in an interim member country partnership strategy agreement it signed two years ago with the Islamic Bank.

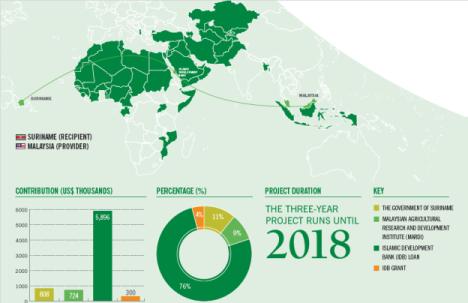

As a result of this support, they were able to identify capacity gaps in rice production in Suriname. The Islamic Bank then was able match the needs of Suriname’s ministry of agriculture, animal husbandry and fisheries with Malaysia’s expertise. The project aims to help Suriname achieve and maintain self-sufficiency in rice production and increase the export of high-quality rice through the Islamic Bank’s “Reverse Linkage” initiative.

This is the sort of South/South cooperation the bank aims to achieve by matching “expertise” with “needs” among its member states